nebraska sales tax rate

The Nemaha sales tax rate is. Groceries are exempt from the Nebraska sales tax.

States With The Highest And Lowest Property Taxes Homes Com

Maximum Local Sales Tax.

. Just enter the five-digit zip code of the location in. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55 percent. The Nebraska sales tax rate is currently.

See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. 800-742-7474 NE and IA. There is no applicable county tax city tax or special tax.

You can print a 55 sales tax table here. Sales Tax Rate Finder. Waste Reduction and Recycling Fee.

Nebraska State Sales Tax. The specific city taxes and rates vary throughout the state. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

Average Sales Tax With Local. Groceries are exempt from the Ord and Nebraska state sales taxes. Nebraska sales tax details.

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325. The county charges 2 percent. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location. NE Sales Tax Calculator. The total tax is 75 percent.

Nebraska Department of Revenue. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Did South Dakota v.

The Omaha sales tax rate is. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. This is the total of state county and city sales tax rates. What is the sales tax rate in Omaha Nebraska.

The base state sales tax rate in Nebraska is 55. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. FilePay Your Return.

For tax rates in other cities see. 30 rows The state sales tax rate in Nebraska is 5500. The Ord Sales Tax is collected by the merchant on all qualifying sales made within Ord.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. Find your Nebraska combined state and local tax rate.

NebraskaCity Sales and Use Tax Return Once Form 20 is submitted the state will begin sending a Form 10 to file sales tax returns. What is the sales tax rate in Nemaha Nebraska. The Nebraska state sales and use tax rate is 55 055.

With local taxes the total sales tax rate is between 5500 and 8000. Average Local State Sales Tax. The state sales tax rate in Nebraska is 55 but you can customize this table as needed.

Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Wayfair Inc affect Nebraska. This is the total of state county and city sales tax rates.

Nebraska has recent rate changes Thu Jul 01 2021. The County sales tax rate is. Did South Dakota v.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The County sales tax rate is. The University of Nebraska System is exempt from these taxes under the Nebraska Revenue Act of 1967 as amended from time to time.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The Total Rate column has an for those municipalities. Nebraska Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax.

Multiply the total sales by the total percentage. The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

Select the Nebraska city from the list of popular cities below to. You can look up your local sales tax rate with TaxJars Sales. 536 rows Nebraska Sales Tax55.

For example Widget A costs 100. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state.

The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Nebraska is a destination-based sales tax state.

The Nebraska NE state sales tax rate is currently 55. Sales and Use Taxes. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value.

Nebraska has a state sales and use tax rate of 55. Printable PDF Nebraska Sales Tax Datasheet. Wayfair Inc affect Nebraska.

2 lower than the maximum sales tax in NE. Maximum Possible Sales Tax. The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

The Nebraska sales tax rate is currently.

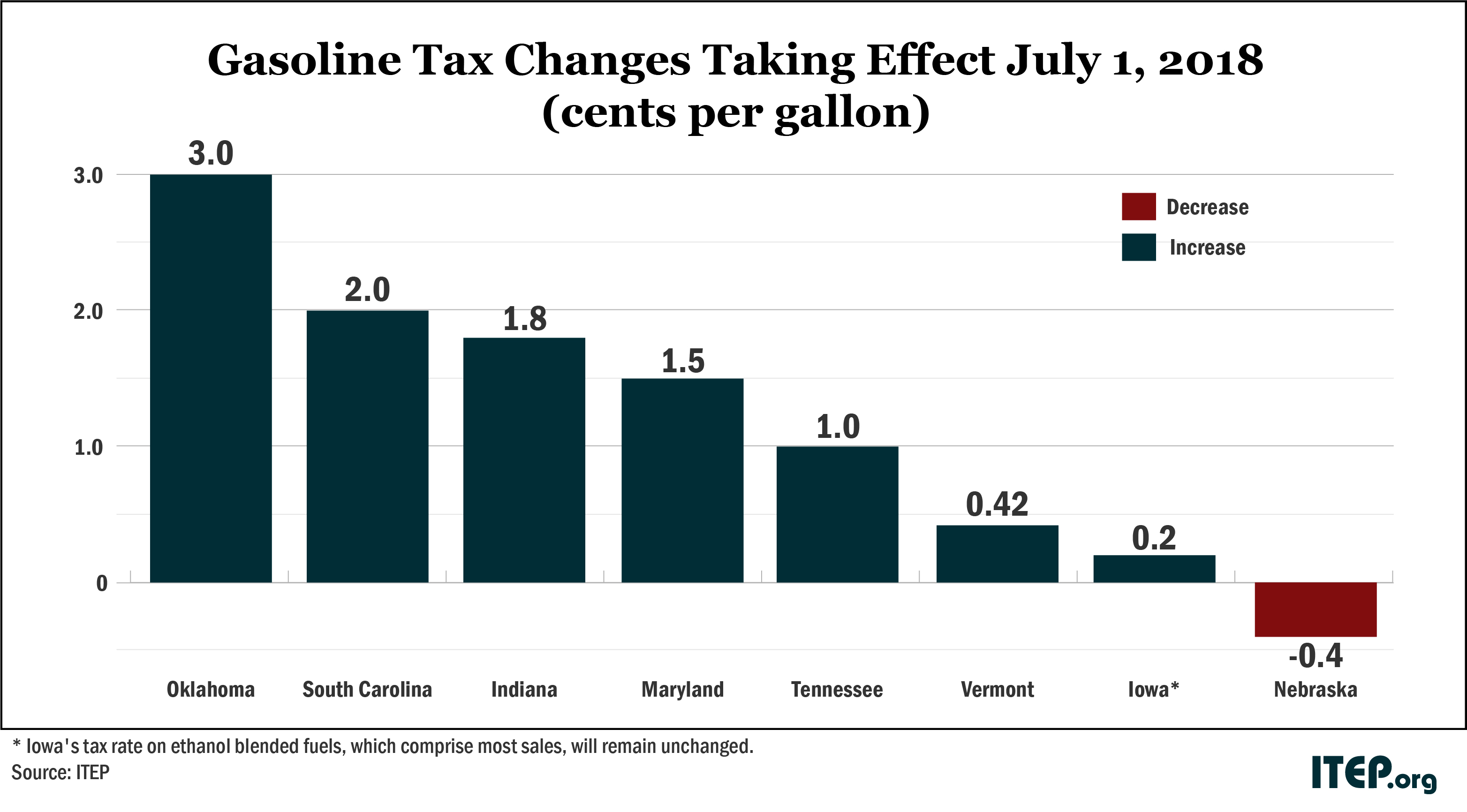

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Nebraska State Tax Refund Tax Brackets State Deductions

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Nebraska Sales Tax Rates By City County 2022

Sales Tax By State Is Saas Taxable Taxjar

Wfr Nebraska State Fixes 2022 Resourcing Edge

Taxes And Spending In Nebraska

Don T Die In Nebraska How The County Inheritance Tax Works

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

General Fund Receipts Nebraska Department Of Revenue

Nebraska And Iowa Groups Call For Uniform Approach To Job Licensing

Taxes And Spending In Nebraska

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

Nebraska Sales Tax Small Business Guide Truic

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare